Claims Management

Experience Strategy & Design - The project started with an exploratory research process that addressed the stated pain points with the existing platform (CIA), as well as an interdisciplinary discovery phase that embraces UX design and technology innovation.

(right: Connected Insurance Services Ecosystem)

Experience Opportunities: Transform claims management workflow and experience design to improve transparency, data insights, decision making, document access/management, and increase ease and usability internally (claims specialists, directors, internal legal counsel) and external users (insured, claimants, legal counsel).

Experience Strategy: Architect the UX to included guided sections and conversational design informed by automation and data intelligence. Improve decision-making through an adaptive workflow allowing claim specialist to have greater control and access to key data and documents that help facilitate increased customer satisfaction and responsiveness.

CX/UX Design research methods

User research was iterative throughout the process. Primary research was conducted at various stages during the project to inform UX design strategy and use of innovative technologies to support users.

UX Research Ops Plan

A structured research plan and roadmap is important for the full product design team. UX/CX research is best integrated within and responsive to the larger product plan to have the greatest strategic impact. Human-centered product research is highly collaborative and iterates along with design and technology.

Service Design

Utilization of hybrid Service Design blueprint at notice of claim reporting to guide investment and design.

1. Identify customer experience gaps

2. Identify opportunities where data personalization could improve the experience

3. Identify touch points where data intelligence could increase performance and accuracy

4. Identify high-value customer interactions

Experience Strategy

The initial contact around a claim or potential claim is an opportunity to reinforce the service promise of brand. Understanding the stress of policyholders at that point in time as well the general strain that professional healthcare workers are under underlies the importance of designing an experience that meets their needs and preferred mode of communication.

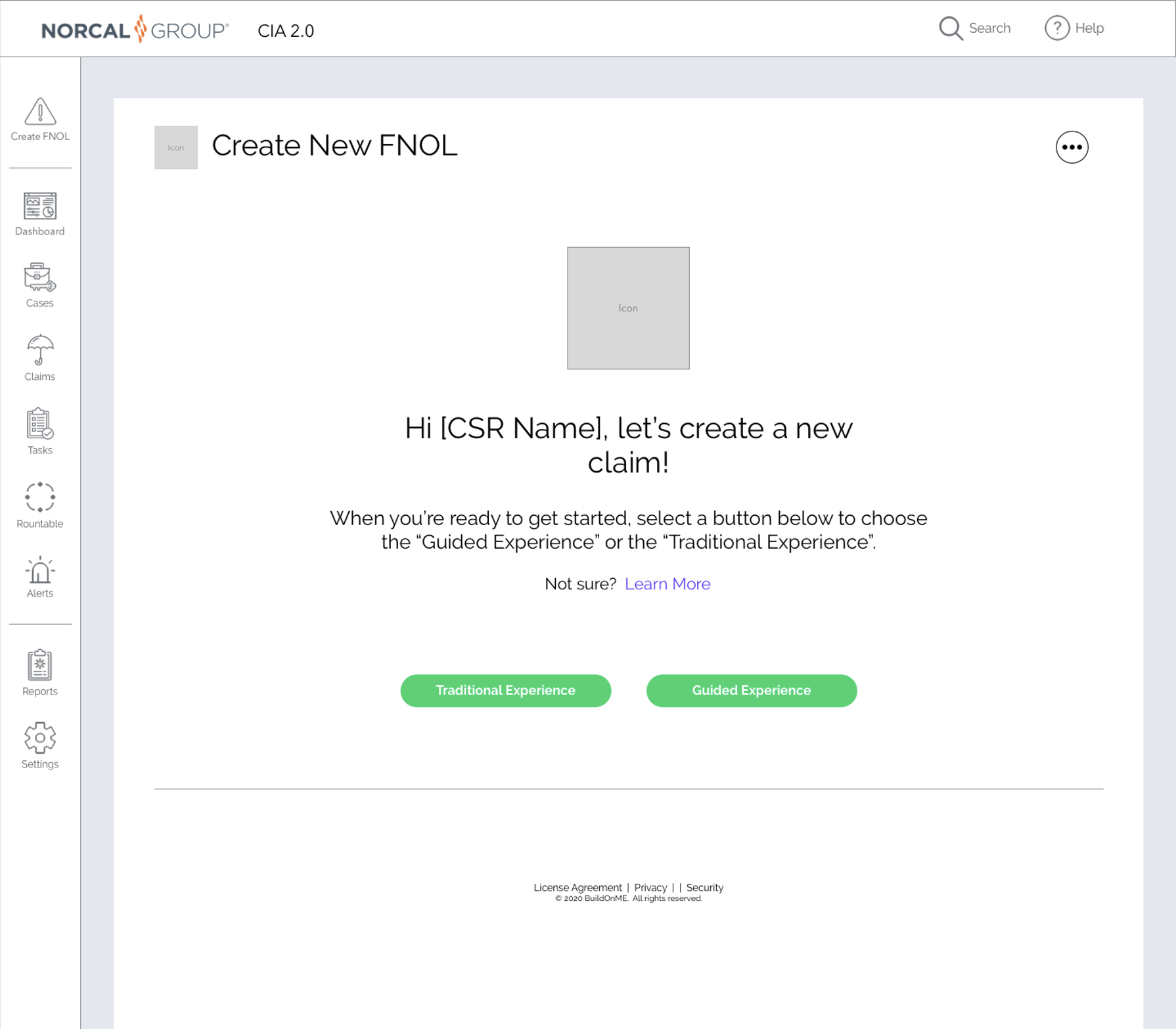

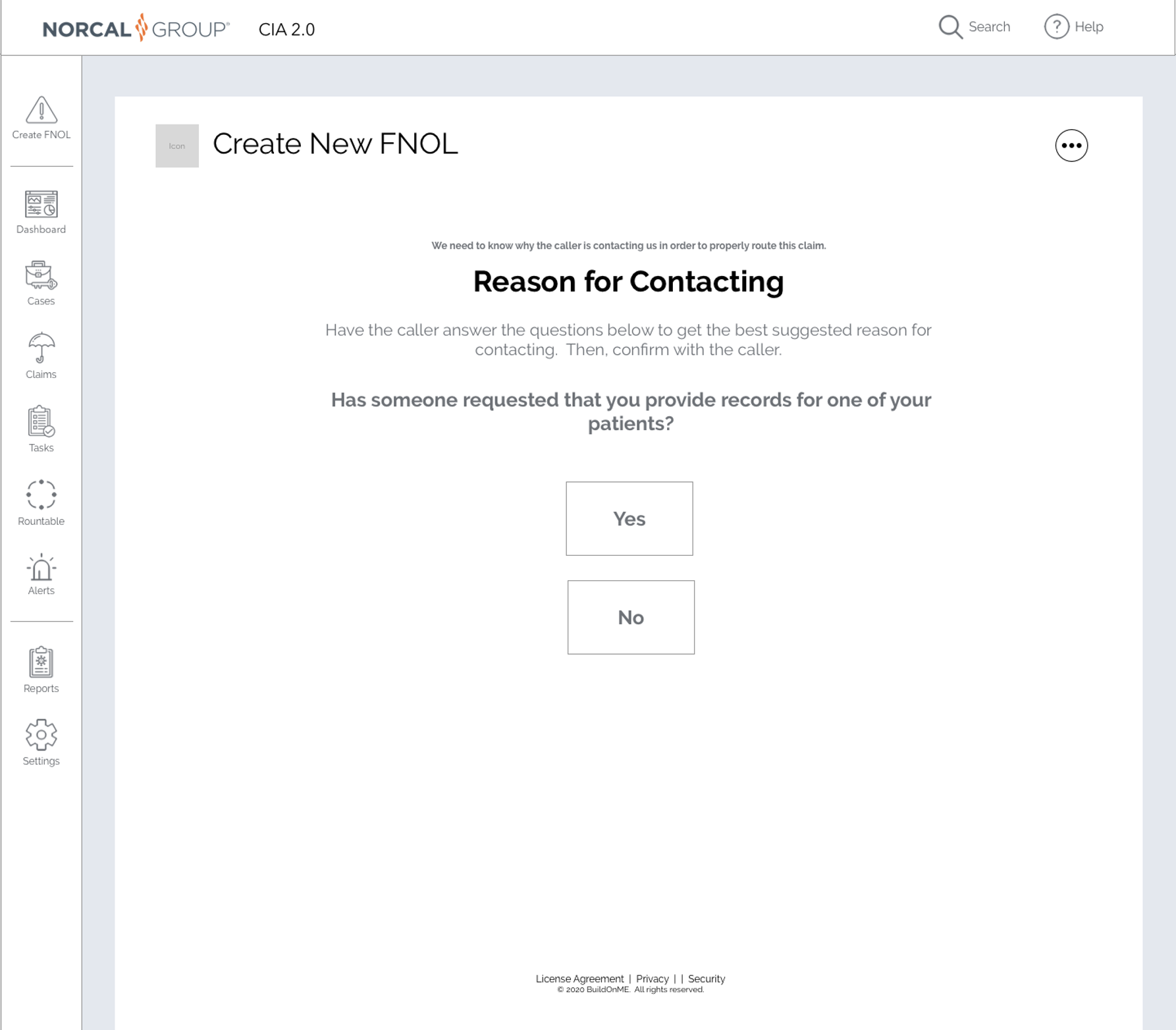

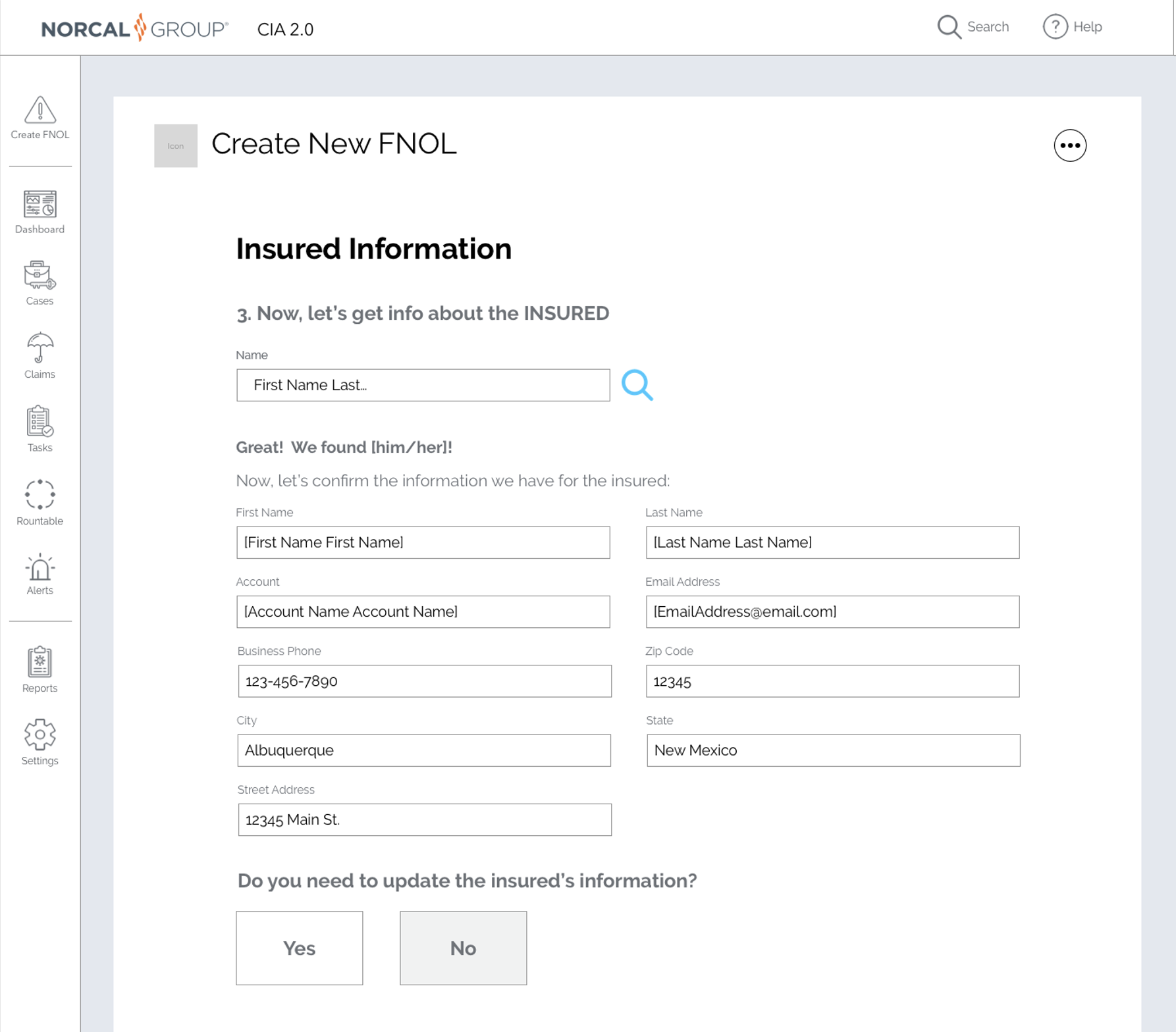

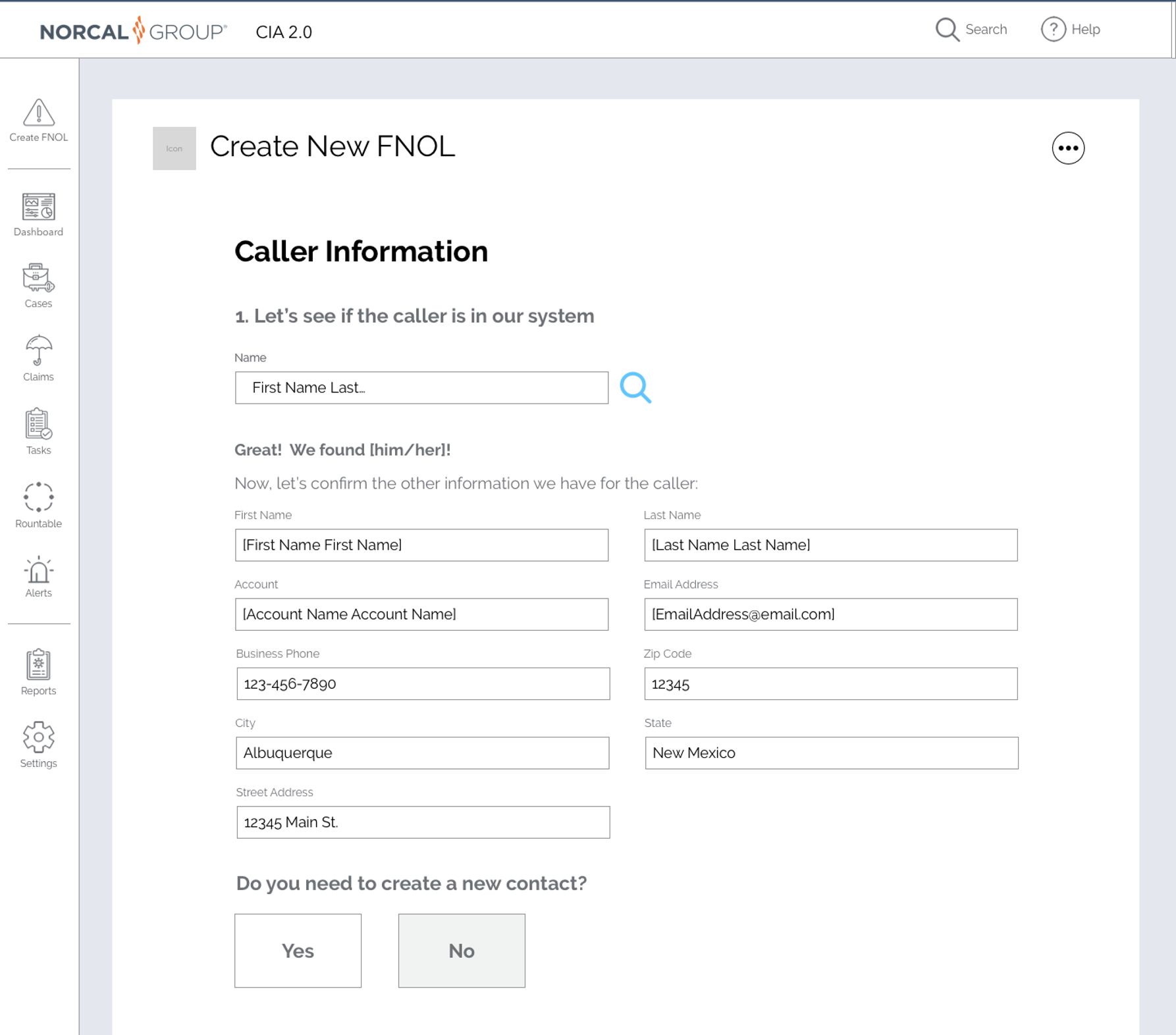

UX design that increases continuity at initial customer contact

Research with call center specialists handling phone-based claim documentation highlighted the existing pain points and data gaps in the existing system and hand-off to Claims Specialists.

1. Lack of continuity and data portability at point of contact / initial data collection step.

2. Improve accuracy of data collection at FNOL step through access to relevant insured profile info, guided experiences, and real-time validation.

3. Increased accuracy identifying caller (often different than the insured) and collection of info around triggers and reason for contact.

Easing the data literacy gap

CX/UX Research Analysis: The self-reported rate of 'slight confidence' of dashboard customization for users (both Directors and Specialist) points to a need/opportunity to improved UX design and contextual learning solutions within the application. Contextual research exposed that some users were opting to not use application tools in favor of paper-based analysis. Additional factors that decrease the comfort are changes/additions to the claims staff requiring onboarding and in-depth training for a tool that is not intuitive (CIA).

CX/UX Data Insights Objectives: To deliver on the potential of a claims management application requires that the primary users are comfortable customizing or manipulating their dashboards to increase efficiency and ability to surface on actionable insights as part of the workflow. The quantitative research in addition to the primary research observing user exposed current system limitations and opportunities to enhance or improve the claims management experience.

CX/UX Recommendations: To increase ease in achieving the user objectives the Claims 2.0 team explore a dashboard configuration tool that consolidates dashboard reports into searchable catalog. Dashboard catalog grouped by role, user-query/ need, region, and system recommendation. The aim is to aid users of different technical skill levels and comfort levels to more easily configure a claims dashboard to meet their needs.

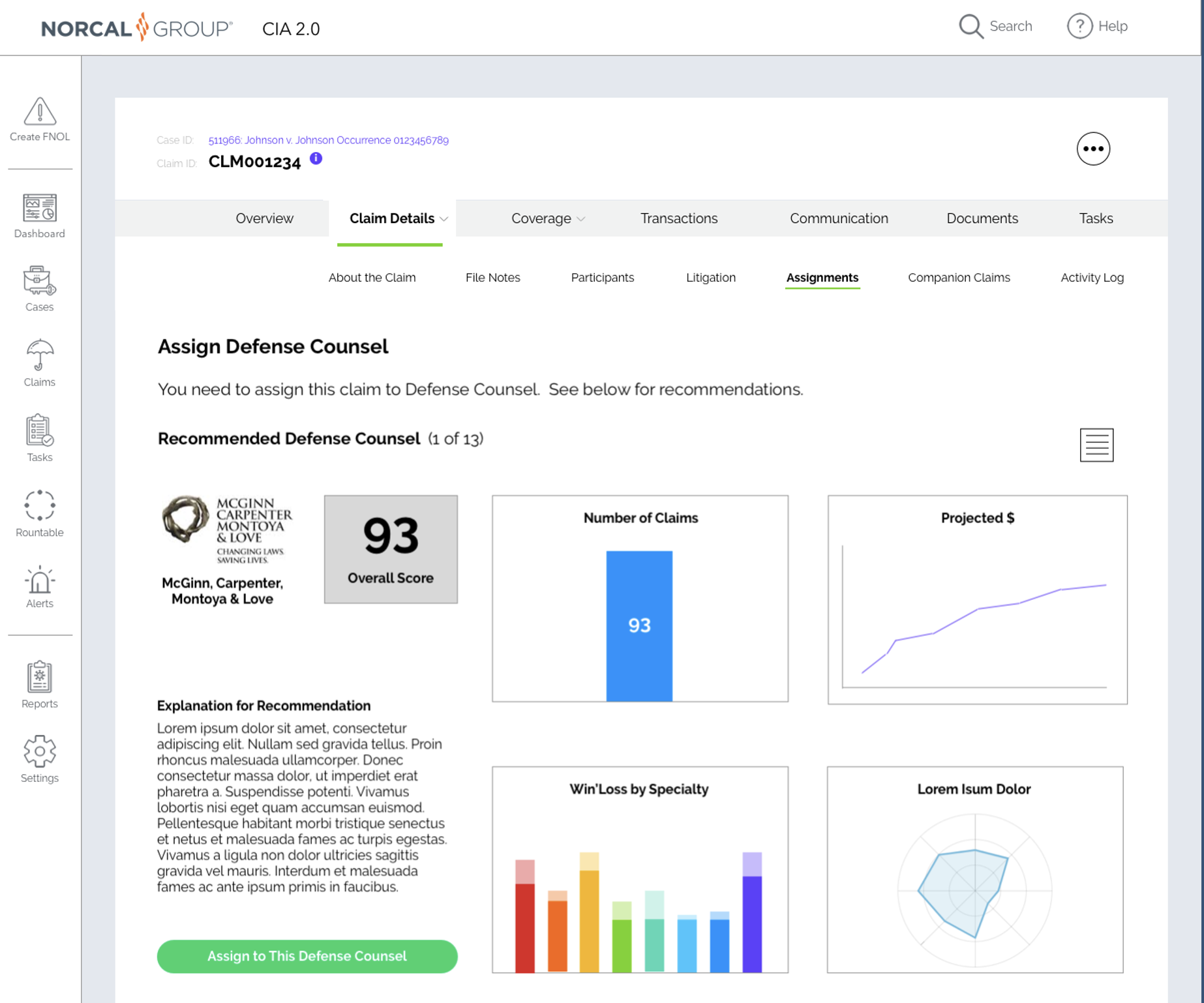

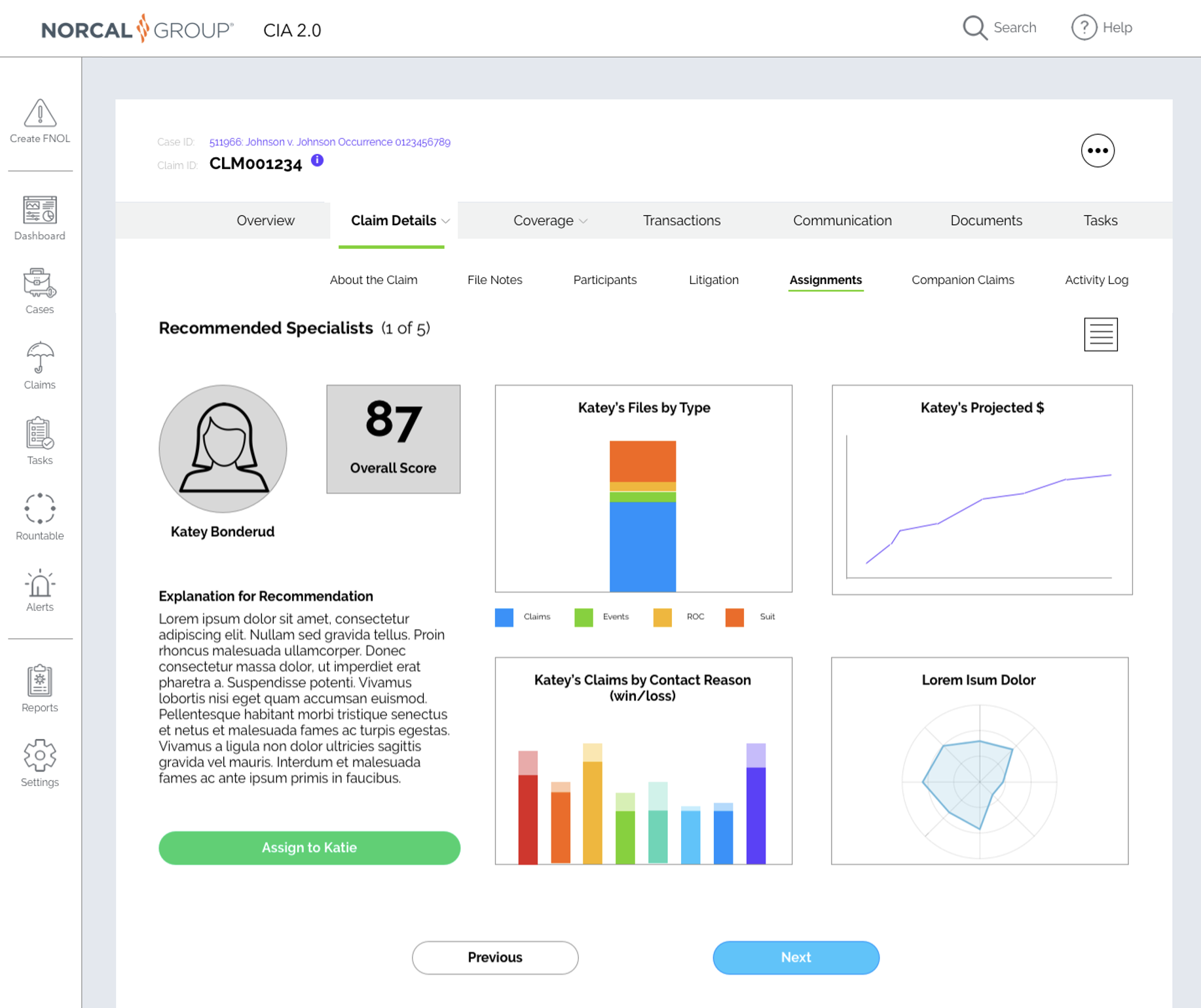

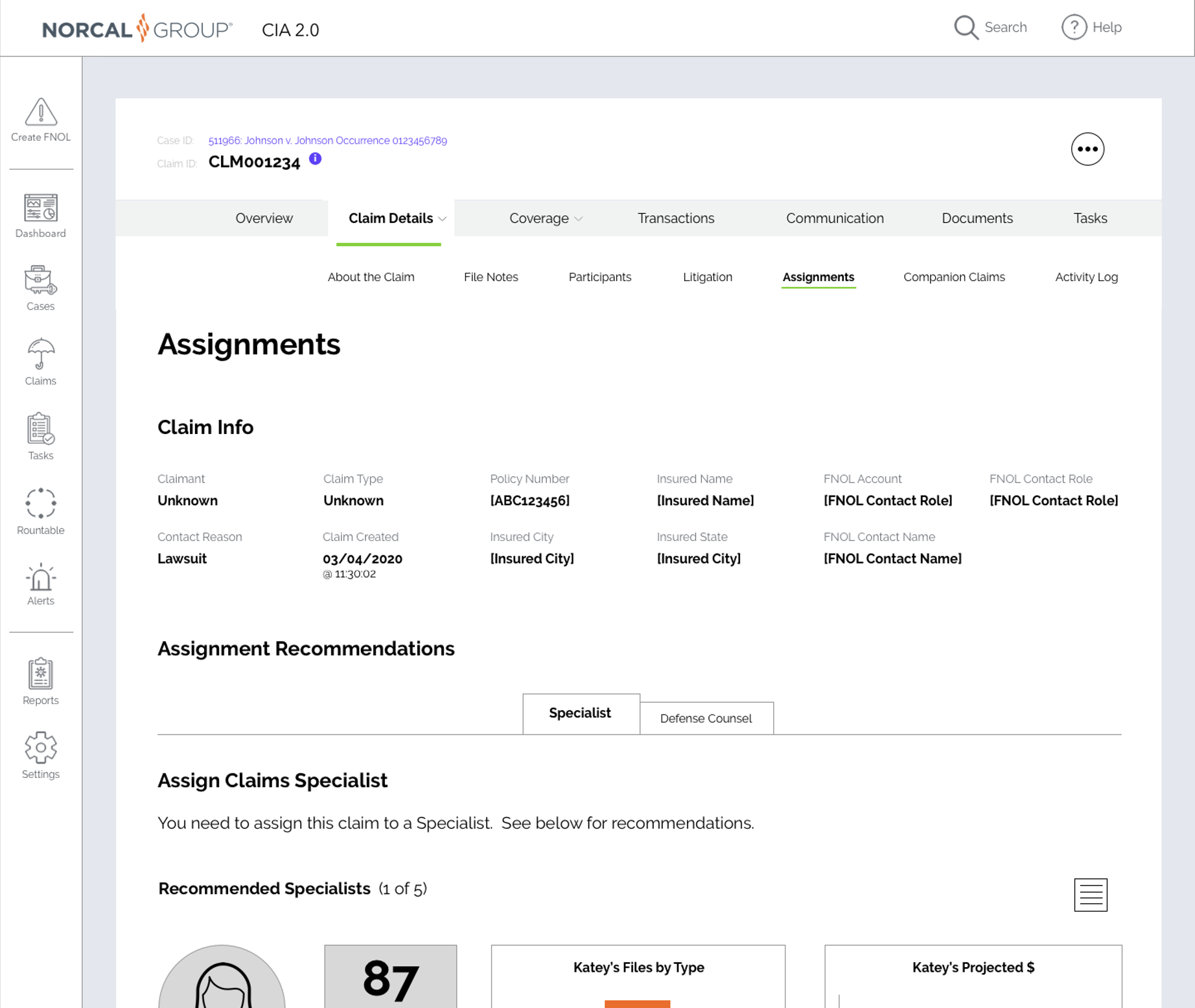

Specialist design research insights

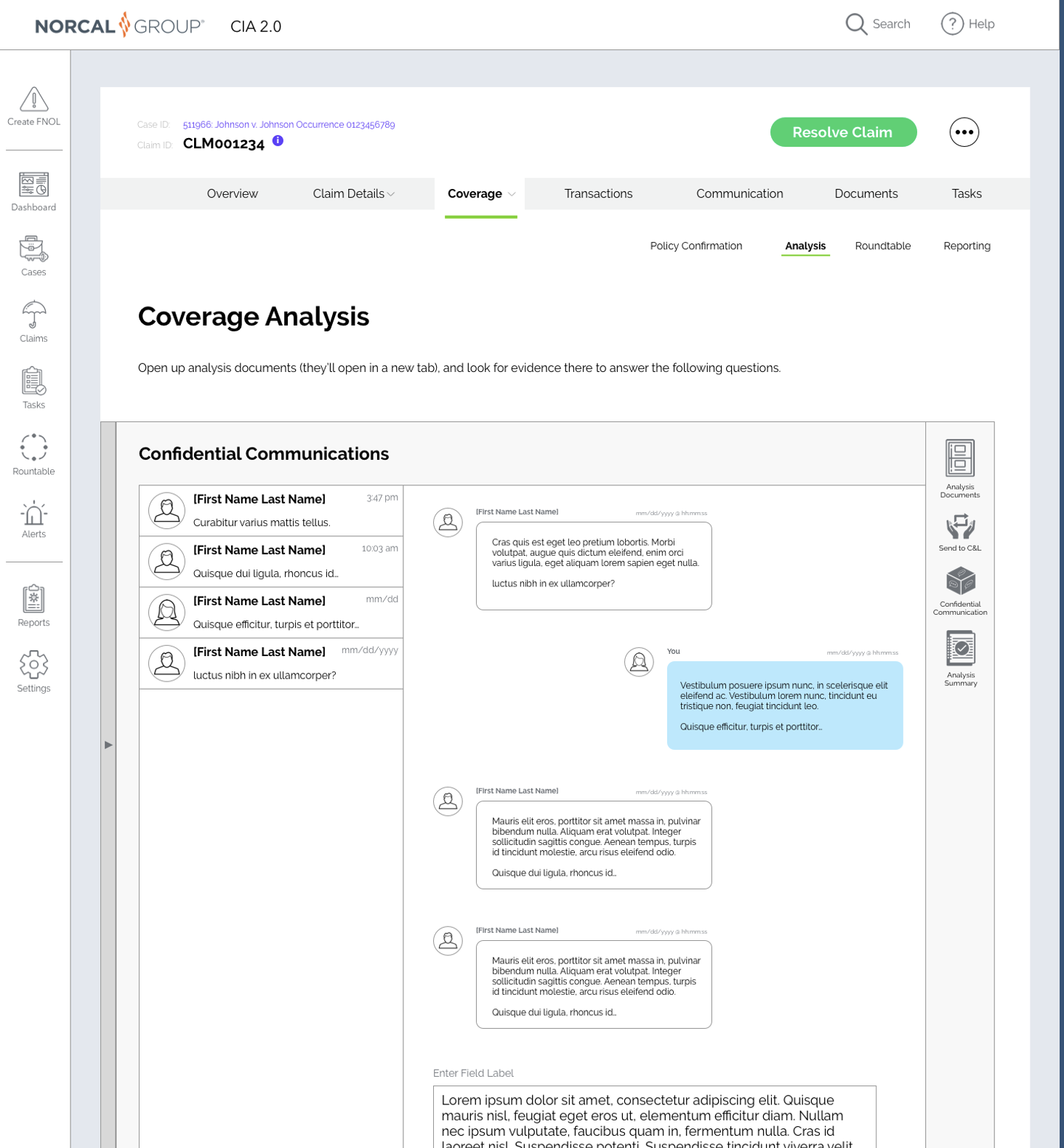

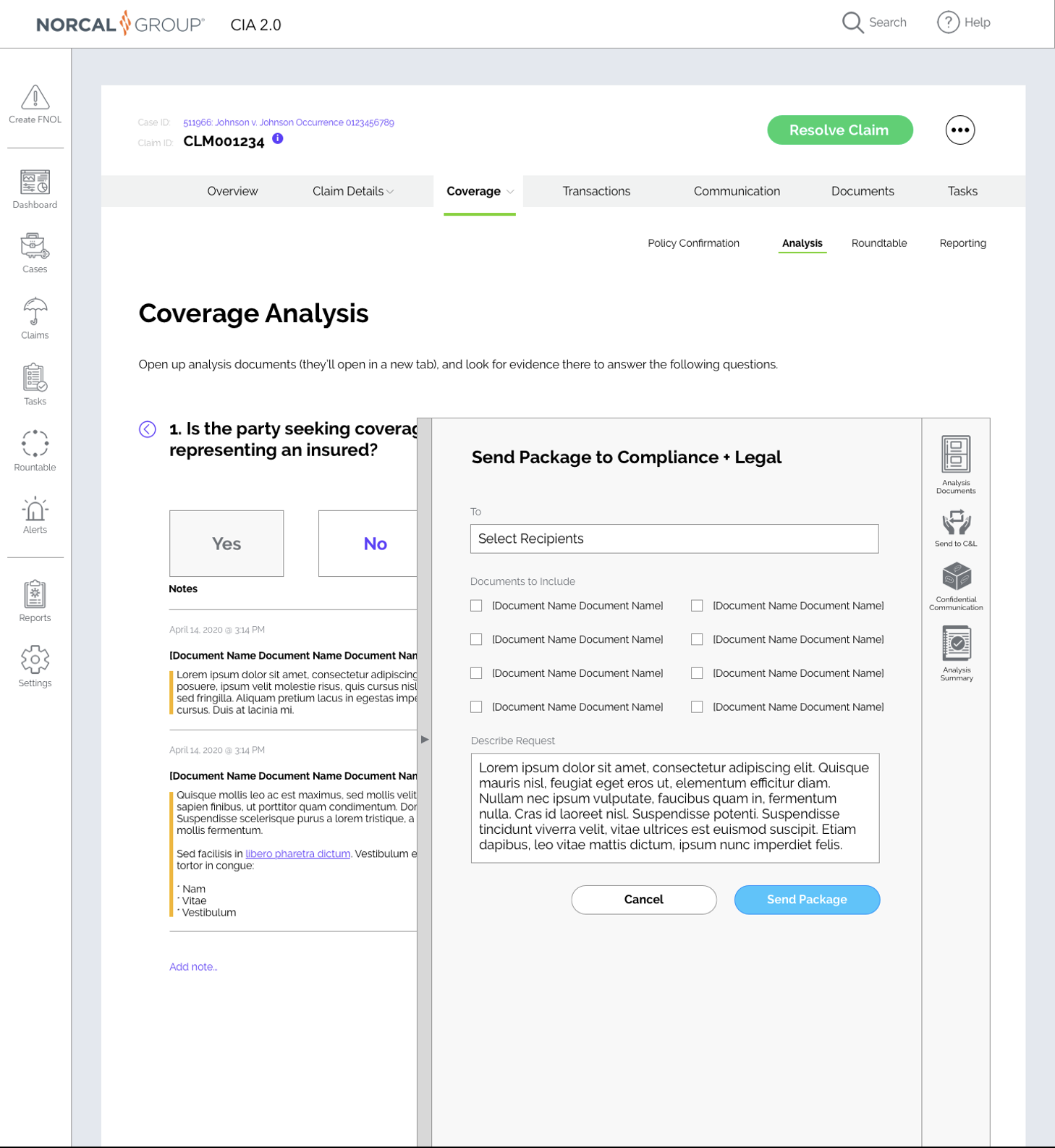

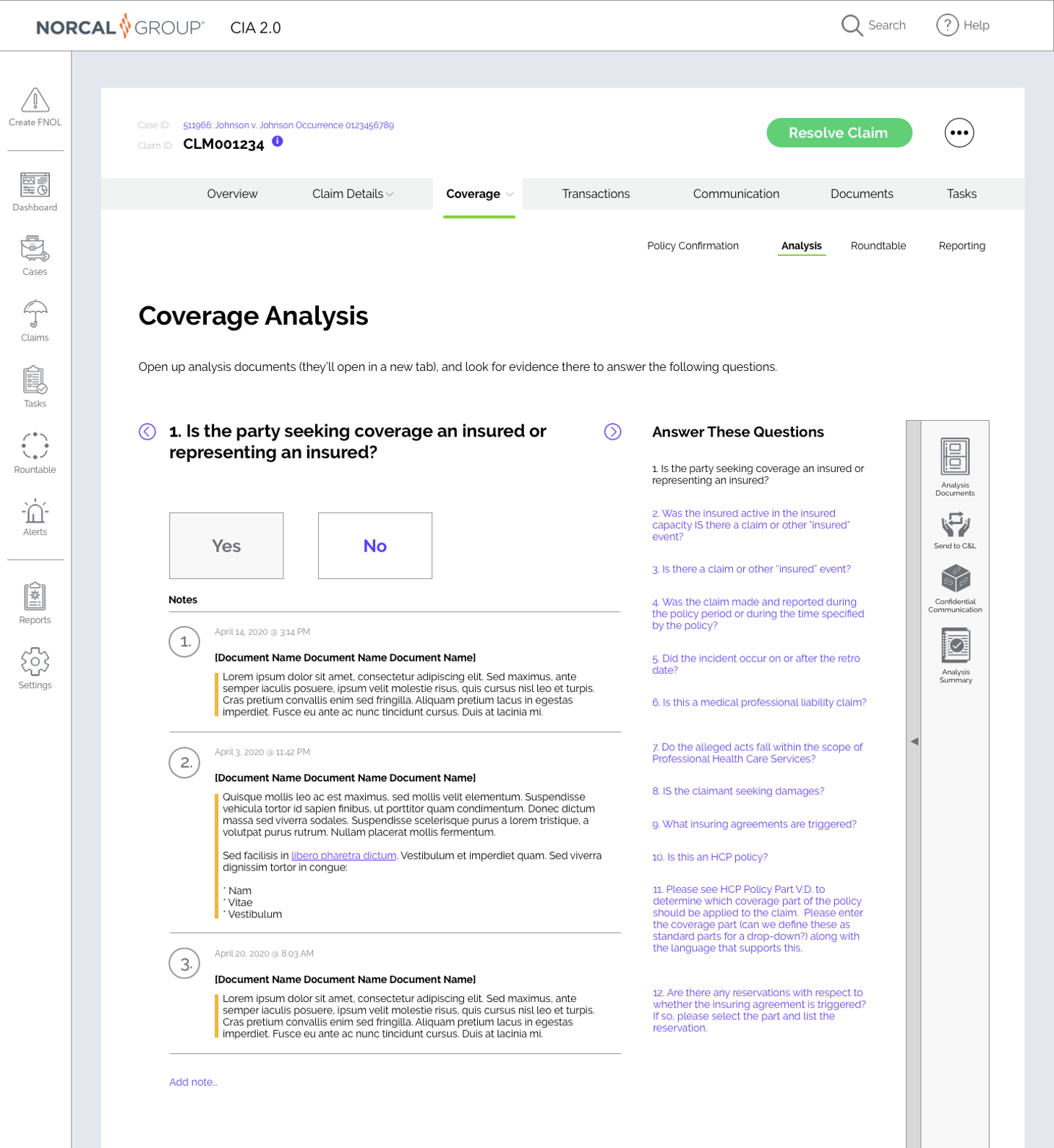

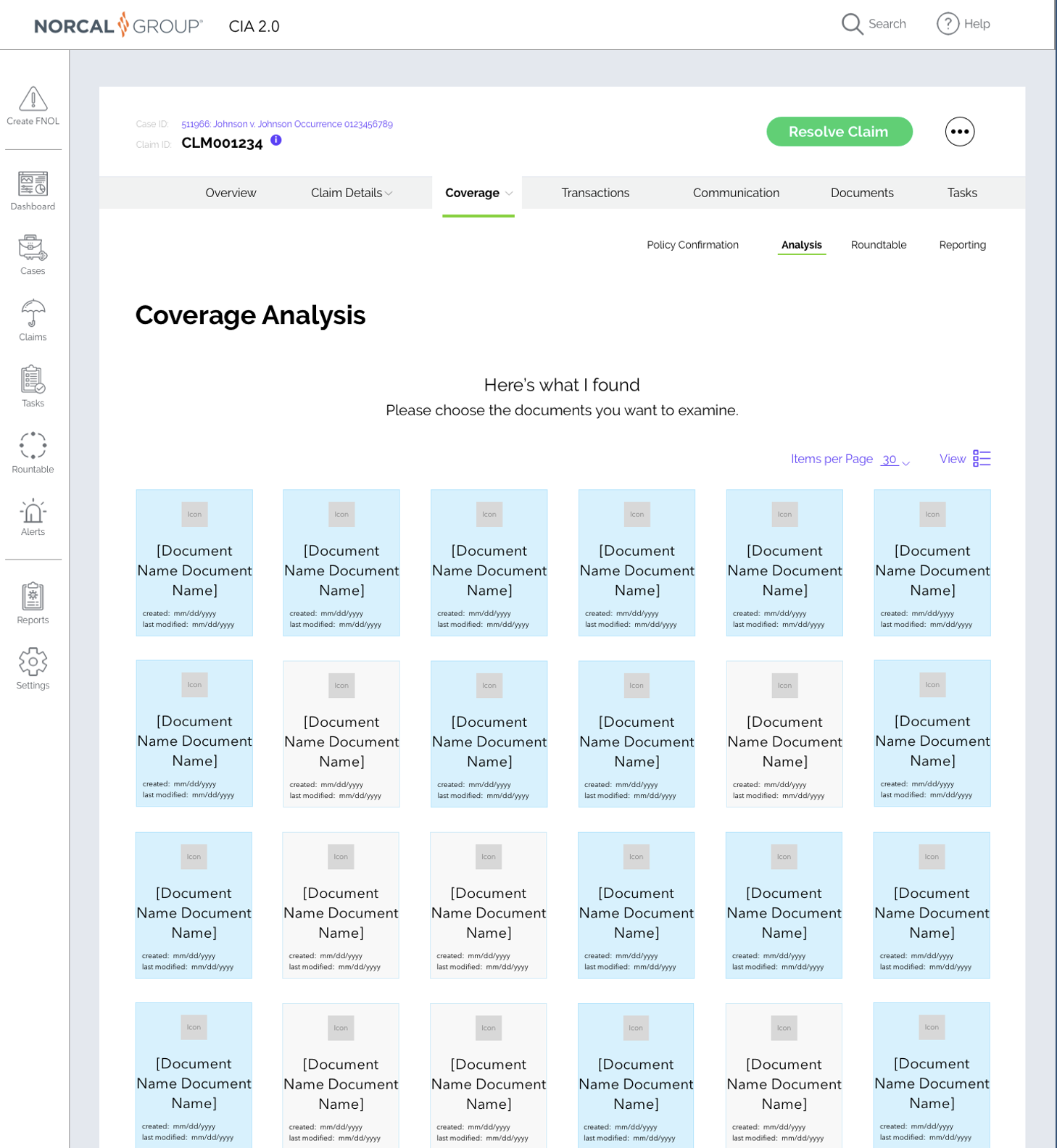

Claims Specialists work across department to verify coverage and perform claim analysis

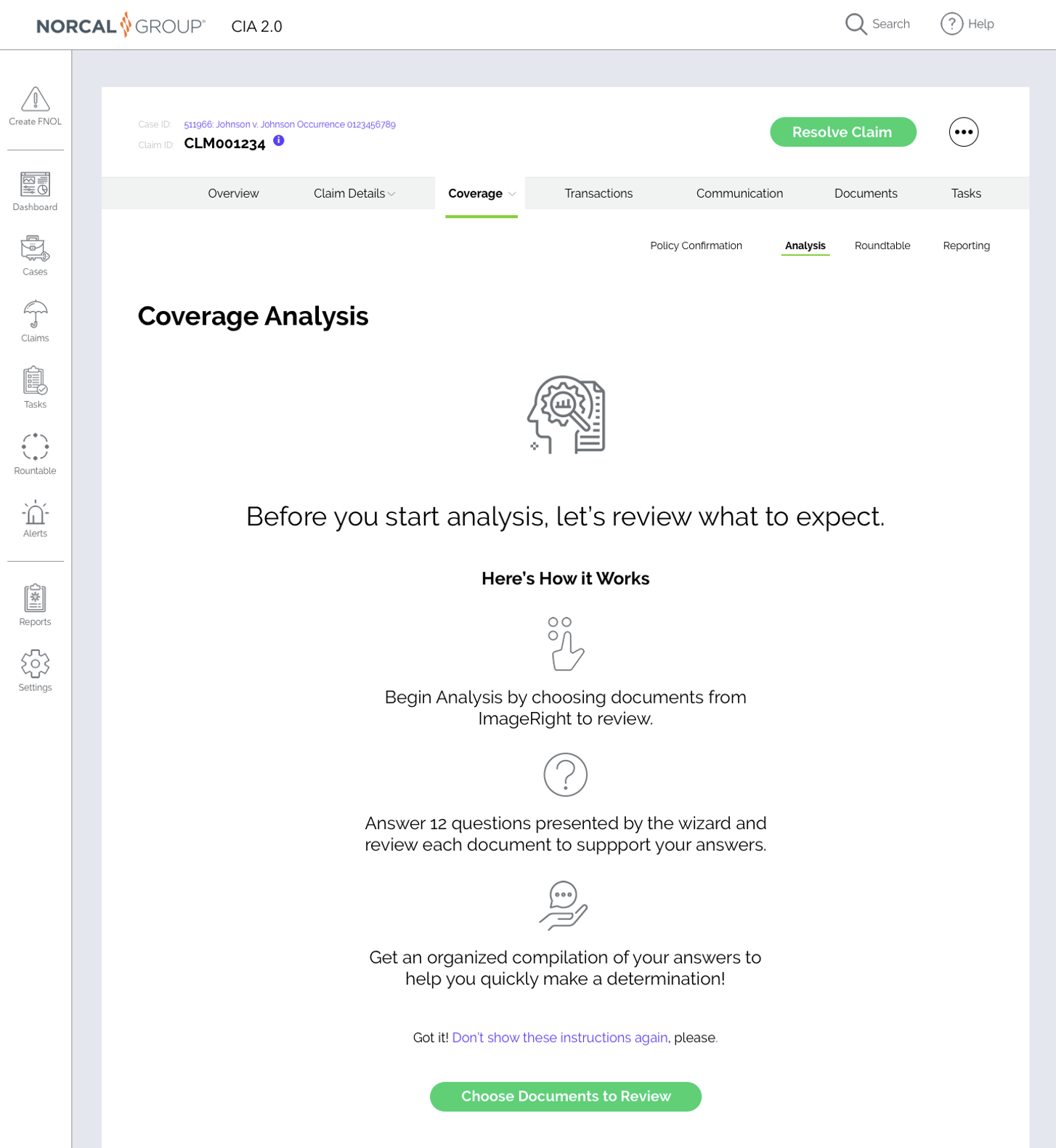

1. A guided experience designed to lessen the organizational burden of specialists by allowing the application to compile relevant documentation and optimize workflows based on data intelligence and machine learning.

2. Use of data intelligence tools that humanize the experience by providing case specific queries and prompts to help frame and give context to the analysis

3. Document management functionality allows for streamlined communication across departments and with claimant and 3rd party participants.

4. Contextualized communication tools allow for protected communication when appropriate.

Conversational design guidelines

Your employee experience (EX) is what makes your CX human, literally.

CLAIMS 2.0 Conversational Design Guidelines

- Legal but warm tone

- Agnostic and evenhanded

- Supportive

- Insight fueled by data

Intelligent Bot self-reference

The role of any intelligent system (AI or machine learning) within Claims 2.0 is to aid or inform the claims specialist. As such the Focus should maintain on the specialist and not shift towards the bot or technology. The application should not engage in self-reference except in support of the claims specialist’s job to be done (e.g. I can assist you by gathering relevant documents).

Focus on the task or flow of tasks

The role of the Claims 2.0 application is supportive and as such should frame work or tasks in context of the case or claim. Focused activity should be achievement focused but with a service mindset.

Experience Flow